Get the app

Download the Curve app and choose which card you want to order. Your card should be with you in 3-5 working days.

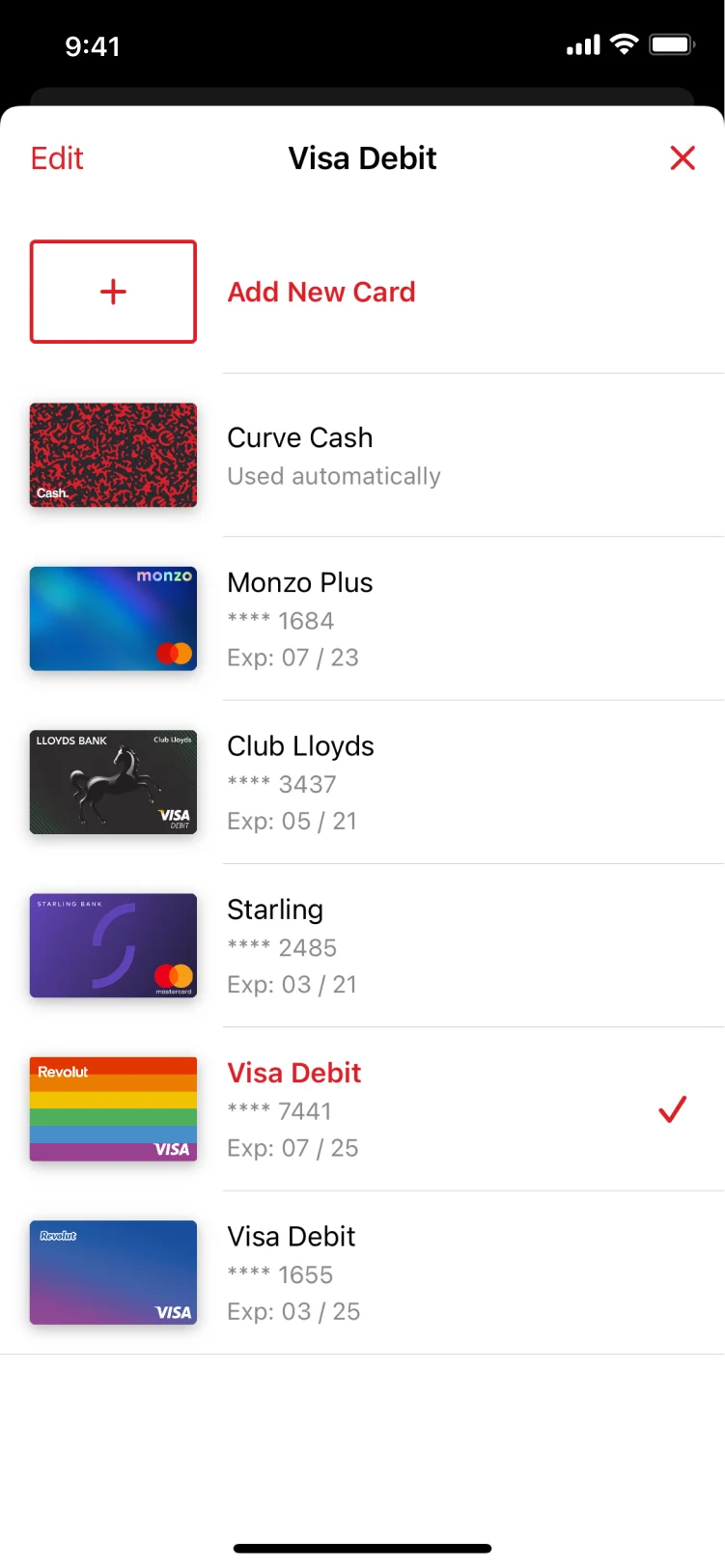

Add your cards

Adding your debit and credit cards is safe and easy. We use bank-level security and no sensitive data is ever saved on your phone. Simply enter your card details or scan your card to upload it to your digital Curve Wallet. For added security, we’ll always ask you to authenticate your cards.

Start spending

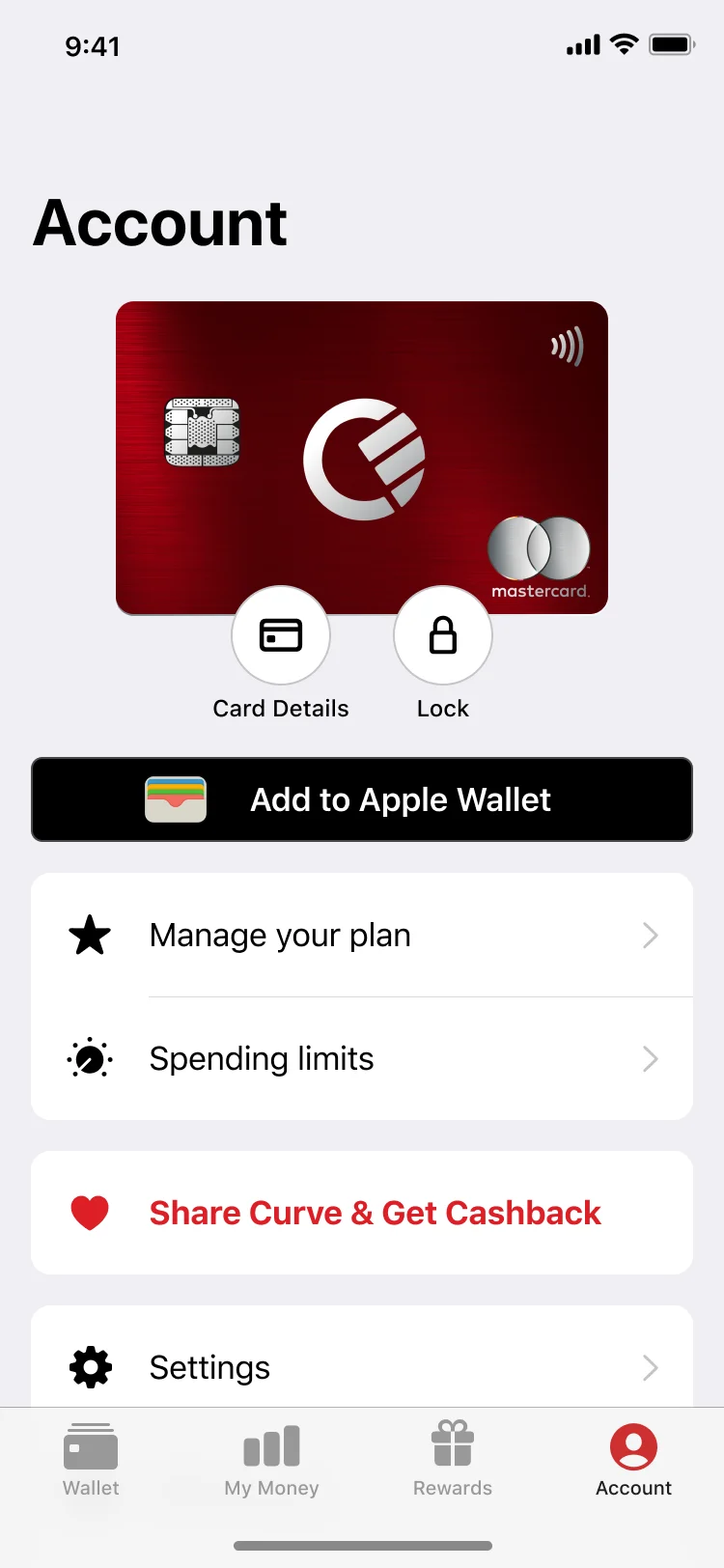

Your physical Curve card will be with you in a few days, but you can start using Curve right away by adding your virtual Curve card to Apple Pay, Google Pay, Samsung Pay, or Curve Pay. Once your card arrives, activate it in the app and you’re good to go.

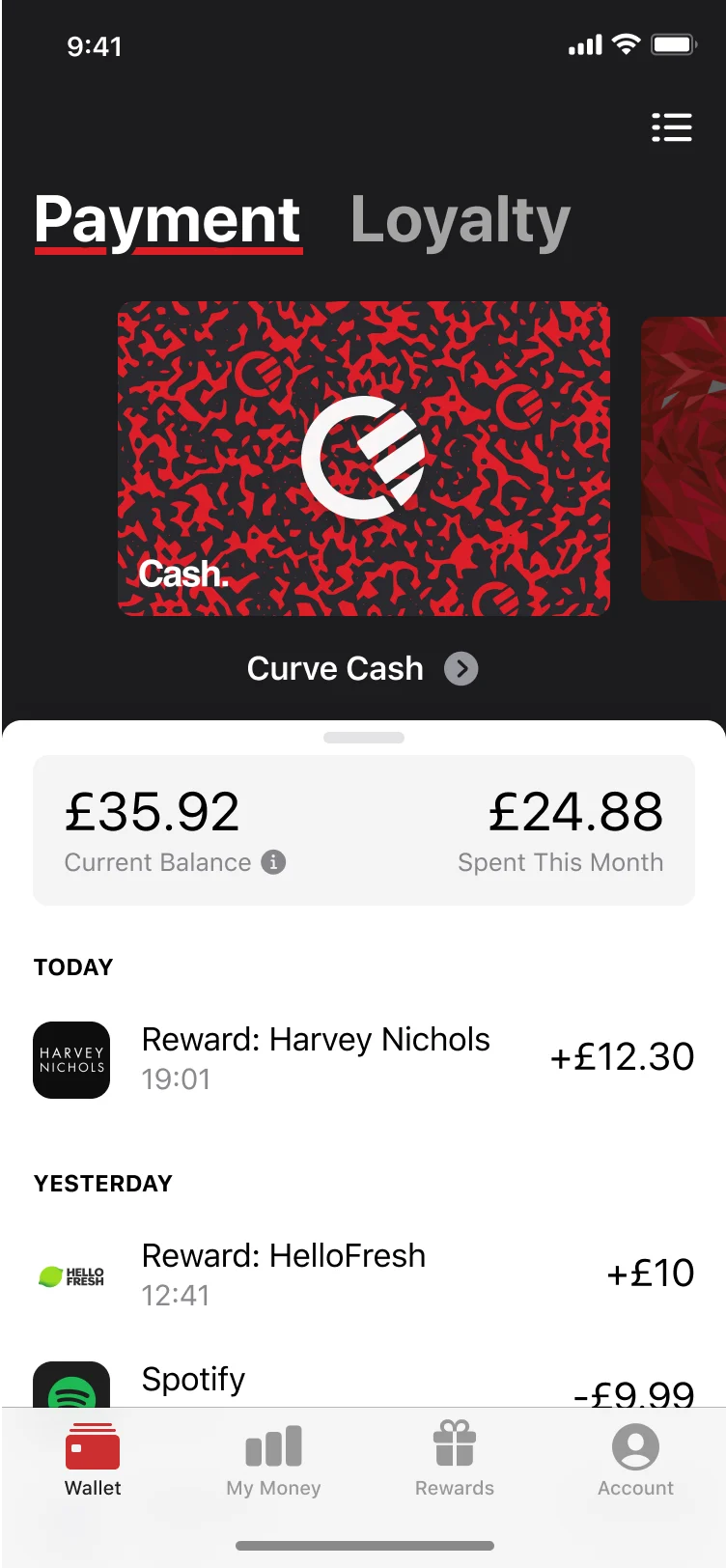

How cashback works

Any cashback you earn will appear in your Curve cash card, a virtual card in your digital Curve Wallet.Your balance can be used automatically or you can turn off auto-spend to save up for a bigger purchase. When you want to pay with your cashback, just select your Curve Cash card like any other card in your Curve Wallet.

Find out more.

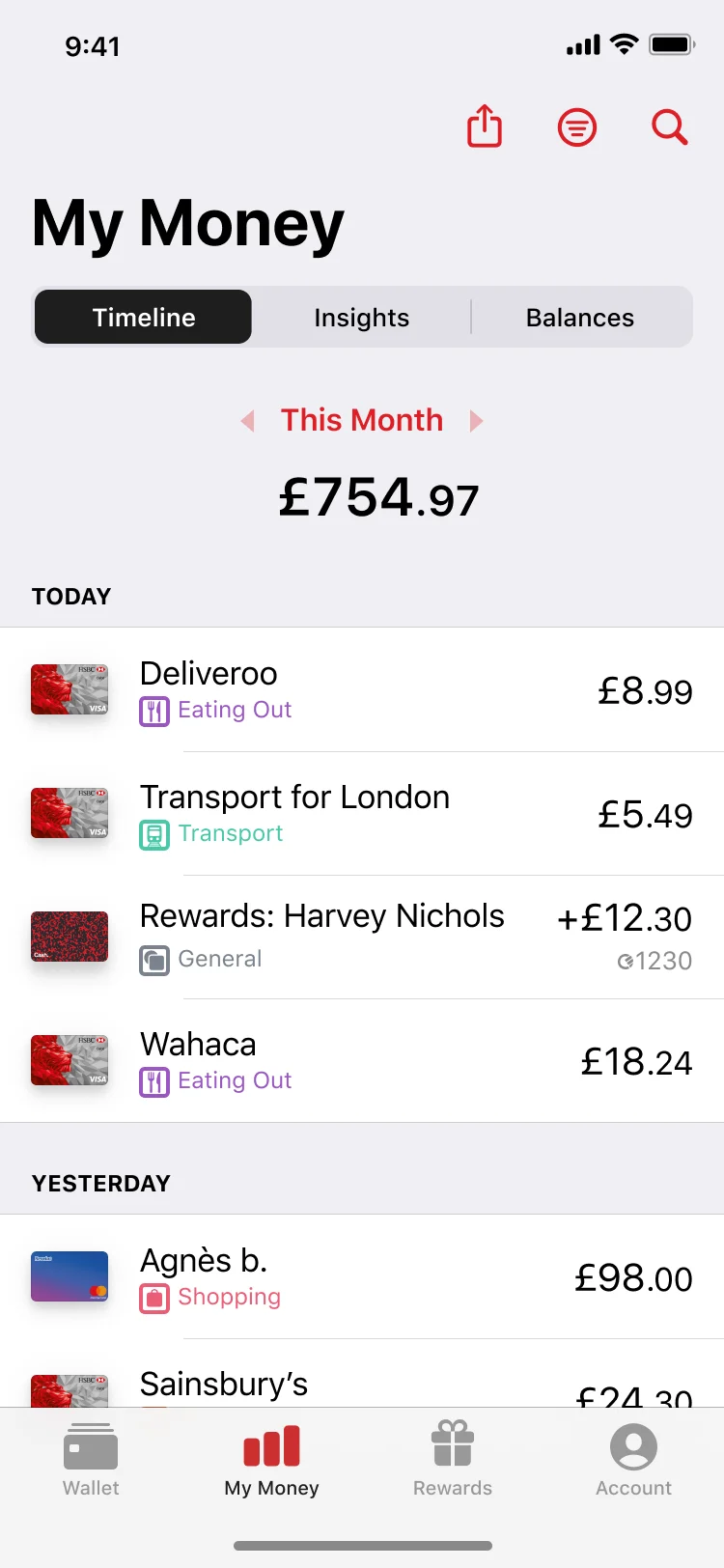

See what you’ve spent

See what you’re spending across all your accounts with Curve insights, alerts and notifications. Your Curve timeline will show you what you’ve spent, when you’ve spent, and where you’ve spent it. You’ll get (optional) notifications every time you spend, and you can check your insights in the app for a categorised breakdown of your transactions across every card.

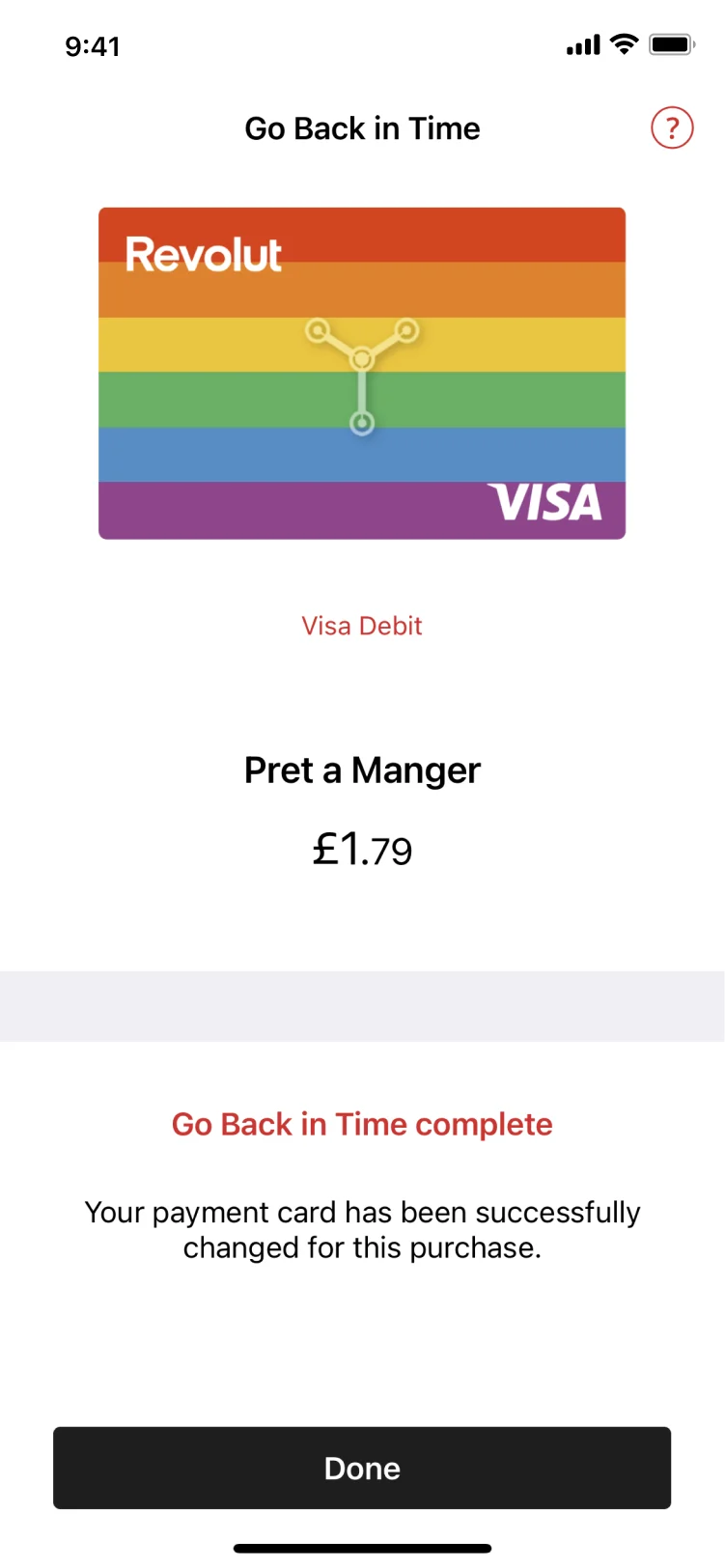

Go Back in Time

Paid on the wrong card? Never mind, rewind. Switch payments from one card to another up to 30 days after the payment was made! Just tap the transaction you want to move, select “Go Back in Time” and swipe to the card you’d like to pay with instead. Yep, time travel is that easy.

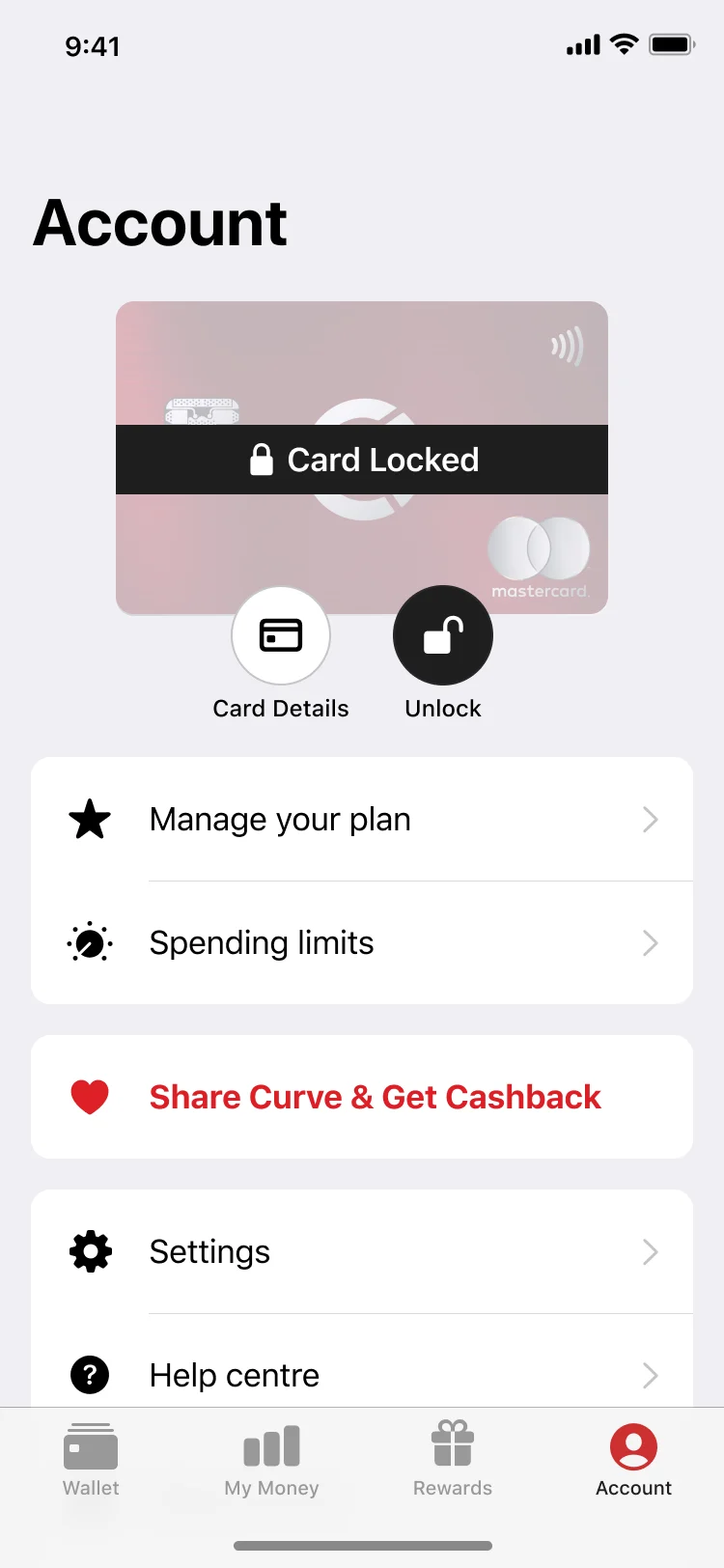

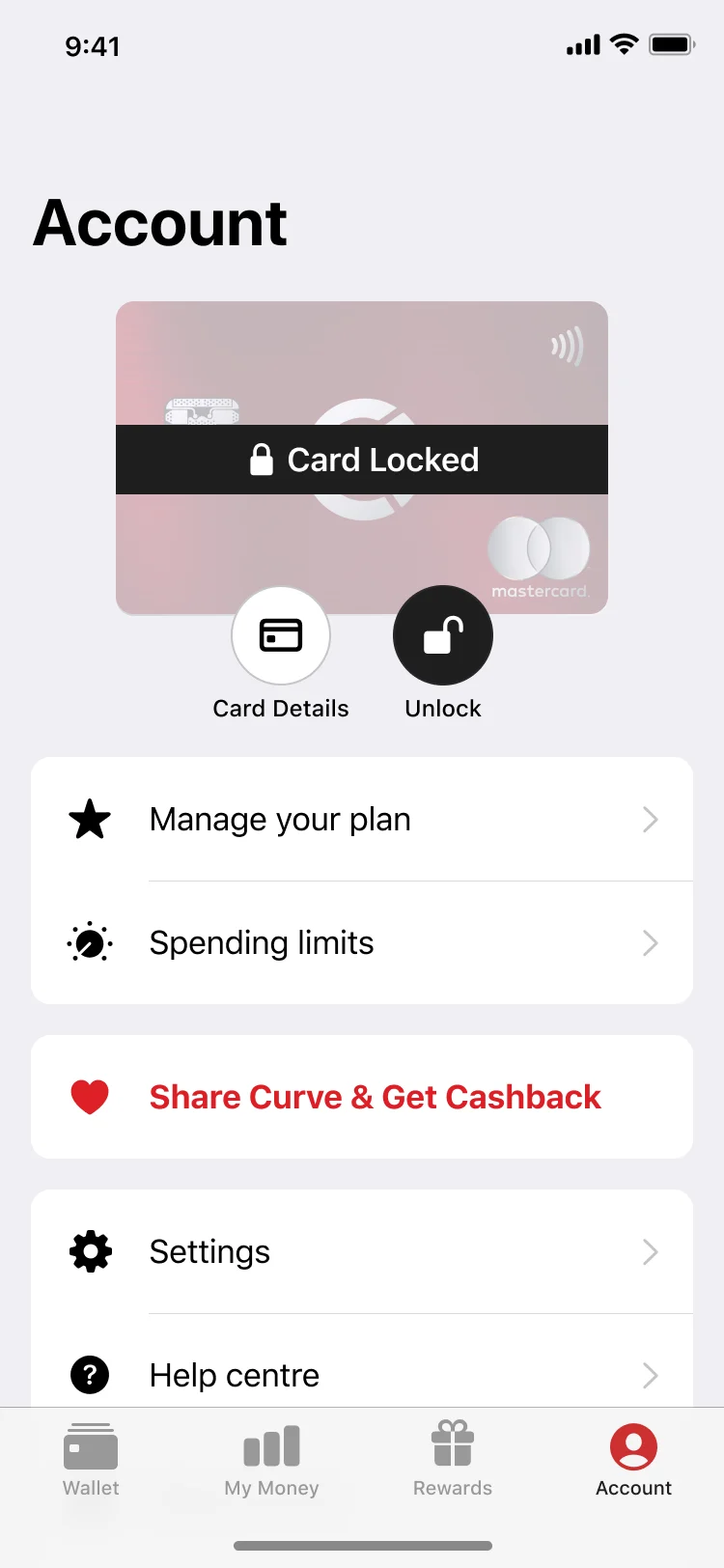

Extra Protection

Lost your Curve Card? Lock it with a single swipe in the app and protect all your cards instantly.

How we do cashback

Curve Cash doesn’t work quite like the paper stuff, but you can spend it just like the real stuff through Curve. Cashback is earned either in Curve points or e-money but your balance will always be shown in real currency. 1 point = £0.01. Cashback earned through 1% cashback or promotional activity is given in points. Cashback earned through Rewards may vary. If a refund is given in Curve Cash, it will always be given in e-money. Points can expire after 6 months while e-money is safeguarded and never expires.

Legal bits:

Curve is available for UK and EEA residents. For now, Curve only supports Mastercard®, Visa, Diner and Discover branded debit and credit cards. Google Pay and Samsung Pay are not available in all countries and software or device restrictions may apply, depending on your device (Apple, Google or Samsung). 1% cashback for Curve Black subscribers at 3 selected retailers and Curve Metal subscribers at 6 selected retailers, for the subscription period. Go Back in Time applies to transactions up to £5,000, made on or after 28 June 2020. Read our privacy policy before using Curve Send. If you’ve lost your phone, download Curve from another device and lock your card there. Not possible? Get in touch with us on the Help page. For UK customers, FSCS protection does not apply to the funds held on your Curve Cash Card and your funds may be at risk in exceptional circumstances. To learn more about how we protect your funds and how we minimise your risk, go here. More information can be found on the FCA website itself, here

Curve UK Ltd, registered in England and Wales, #09523903 Copyright - 2024 © Curve UK Limited.

The Curve Card, the Samsung Pay+ and the E-money related to these cards is issued in the UK by Curve UK Limited, authorised and regulated by the Financial Conduct Authority to issue electronic money (firm reference number 900926). Curve UK Limited is registered in England and Wales, United Kingdom (company reference number: 09523903) and located at 1-10 Praed Mews, London, W2 1QY.

Curve Flex is provided in the UK by Curve Credit Limited. Curve UK Limited is an introducer appointed representative of Curve Credit Limited, which is authorised and regulated by the Financial Conduct Authority (firm reference number 925447). Curve Credit Limited is registered in England and Wales, United Kingdom (company reference number: 12464458) and located at 1-10 Praed Mews, London, W2 1QY.

The Curve Card and the e-money related to cards issued in the EEA is issued by Curve Europe UAB, authorised in Lithuania by the Bank of Lithuania (electronic money institution license No. 73 issued on 22 of October, 2020). The Curve Card and Samsung Pay+ are issued pursuant to license by Mastercard International Inc. Mastercard® is a registered trademark of Mastercard International Incorporated. Curve Europe UAB is registered in Lithuania (company reference number: 305626541) and located at Jogailos g. 9, LT-01116 Vilnius.